Exclusive Investment Opportunity

Invest in Black Hawk Apartments in Fort Wayne, IN

Projected 16% – 18% IRR, 7% Preferred Return, 2.0x Equity Multiple, 100% Bonus Depreciation Back — with an assumable agency loan in place.

7 reasons Why we love this deal

Premium Townhome Layouts

67% of units are spacious townhomes — rare in the area. Drives retention, attracts families, and commands higher rents.

Proven Value-Add with Scalable Upside

Only 15 of 209 units have been renovated — those generate up to $345/month rent bumps. 194 units remain to be updated.

Fast-Growing, Job-Rich Market

Fort Wayne has 2.7% unemployment and over $1B in new corporate investment from Amazon, GM, FedEx, and healthcare systems.

Strong Cash Flow + Downside Protection

92% current occupancy, 73% breakeven, and assumable Fannie Mae debt at 5.49% with 17 months interest-only.

Accelerated Depreciation via Cost Seg Study

100% bonus depreciation back for LPs in 2025. K-1s delivered annually for tax optimization.

$460 Rent vs. Own Gap

Even post-reno, rents are $460/month below housing costs — delivering affordability and protection in downturns.

Vertically Integrated Management Team

Hudson Residential will lead operations with AI-enhanced leasing, maintenance, and underwriting efficiencies.

INVESTOR SNAPSHOT

Target IRR

Cash-on-Cash

Equity Multiple

Minimum Investment

Hold Period

First Distribution

Legal Structure

Bonus Depreciation

Financing

Financing

16% – 18%

7% Preferred Return

2.0x

$100,000

5 Years

Q1 2026 (from Q4 2025)

506(c) - Accredited Only

Yes - 100% in Year 1

Assumable Fannie Mae Loan

@ 5.49%

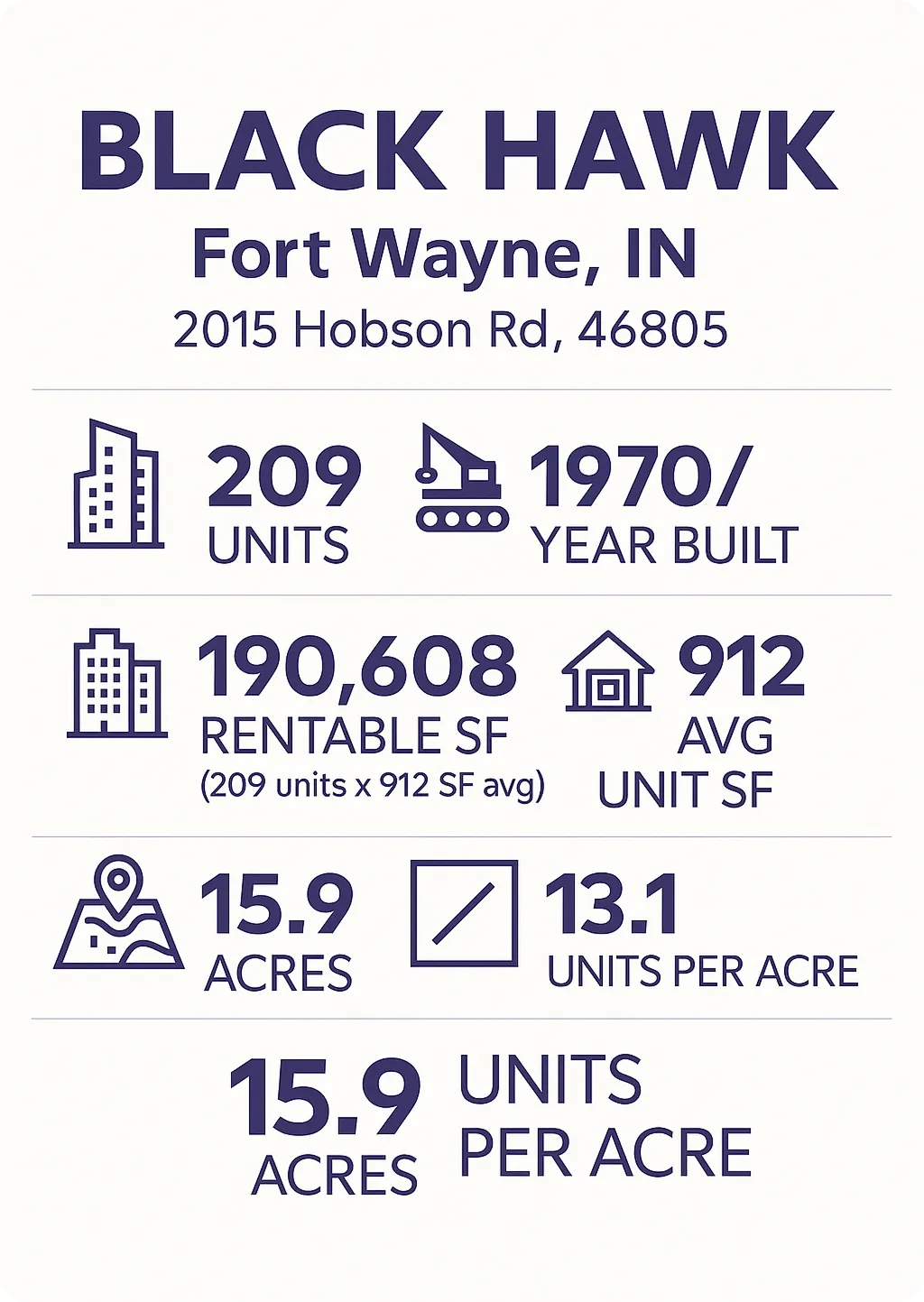

Property Summary

Venus Capital Partners is proud to present our newest value-add opportunity!

the black hawk

Venus Capital Partners present Black Hawk Apartments, a 209-unit, townhome-heavy value-add community located in Fort Wayne, Indiana—one of the Midwest’s fastest-growing and most economically resilient secondary markets.

Surrounded by over $1B in regional investment and boasting submarket-leading rent growth, Fort Wayne offers a compelling backdrop for both cash flow and appreciation.

Black Hawk features a rare 67% townhome unit mix, offering larger floorplans and greater tenant retention.

Only 15 units have been renovated to date, achieving rent premiums of up to $345/month. Our vertically integrated team will execute a proven value-add strategy across the remaining 194 units, with additional upside from amenity enhancements, a fiber internet rollout, and clubhouse modernization.

This opportunity combines reliable in-place income (92%+ occupancy), a scalable renovation roadmap, and the option to benefit from accelerated depreciation via a cost segregation study.

With a projected 16–18% IRR and 2.0x equity multiple, Black Hawk is positioned to deliver strong, risk-adjusted returns in a supply-constrained, affordability-advantaged market.

Why we love this deal

Premium Townhome Layouts

67% of units are spacious townhomes — rare in the area. Drives retention, attracts families, and commands higher rents.

Proven Value-Add with Scalable Upside

Only 15 of 209 units have been renovated — those generate up to $345/month rent bumps. 194 units remain to be updated.

Fast-Growing, Job-Rich Market

Fort Wayne has 2.7% unemployment and over $1B in new corporate investment from Amazon, GM, FedEx, and healthcare systems.

Strong Cash Flow + Downside Protection

92% current occupancy, 73% breakeven, and assumable Fannie Mae debt at 5.49% with 17 months interest-only.

Accelerated Depreciation via Cost Seg Study

100% bonus depreciation back for LPs in 2025. K-1s delivered annually for tax optimization.

$460 Rent vs. Own Gap

Even post-reno, rents are $460/month below housing costs — delivering affordability and protection in downturns.

Vertically Integrated Management Team

Hudson Residential will lead operations with AI-enhanced leasing, maintenance, and underwriting efficiencies.

Property Summary

Venus Capital Partners is proud to present our newest value-add opportunity!

the black hawk

Venus Capital Partners present Black Hawk Apartments, a 209-unit, townhome-heavy value-add community located in Fort Wayne, Indiana—one of the Midwest’s fastest-growing and most economically resilient secondary markets.

Surrounded by over $1B in regional investment and boasting submarket-leading rent growth, Fort Wayne offers a compelling backdrop for both cash flow and appreciation.

Black Hawk features a rare 67% townhome unit mix, offering larger floorplans and greater tenant retention. Only 15 units have been renovated to date, achieving rent premiums of up to $345/month.

Our vertically integrated team will execute a proven value-add strategy across the remaining 194 units, with additional upside from amenity enhancements, a fiber internet rollout, and clubhouse modernization.

This opportunity combines reliable in-place income (92%+ occupancy), a scalable renovation roadmap, and the option to benefit from accelerated depreciation via a cost segregation study.

With a projected 16–18% IRR and 2.0x equity multiple, Black Hawk is positioned to deliver strong, risk-adjusted returns in a supply-constrained, affordability-advantaged market.

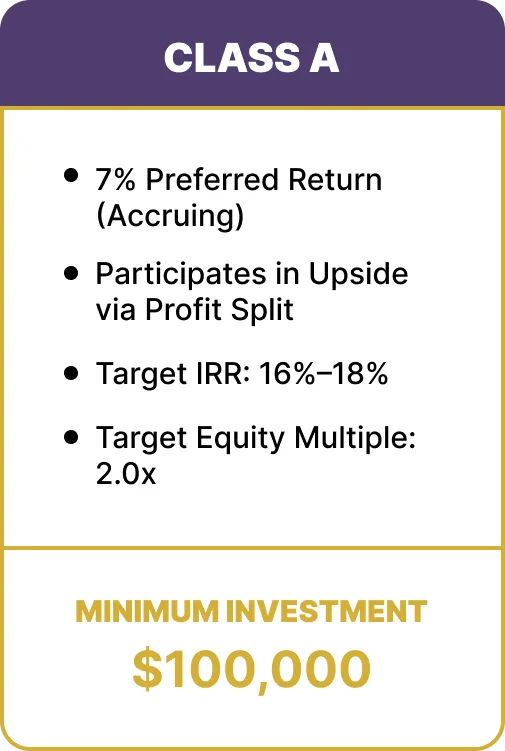

Equity Structure

*For Accredited Investors*

Built for Cash Flow and Long-Term Upside

This offering features a single equity class designed to deliver a strong balance of income and appreciation. Investors receive a 7% preferred return, along with participation in upside through a profit split structure. With a minimum investment of $50,000, Class B provides aligned incentives, tax benefits, and stable risk-adjusted returns over a 5-year hold.

investment summary

FORT WAYNE

The Heart of the Midwest

#Top 2 Fastest-Growing Metro in the Great Lakes Region

FORT WAYNE, IN

A City on the Rise

Population + Job Market Momentum:

2.1% projected growth (5-mile radius by 2029)

14.3% income growth forecasted within 5 years

Top 2 Fastest-Growing Metros in the Great Lakes Region

250,000+ annual graduates from nearby R1/R2 universities

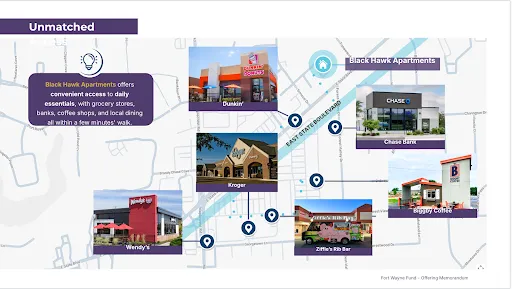

UNMATCHED

MEET YOUR SPONSOR

Venus Capital + Hudson Investing

Vanessa Alfaro

CEO, Venus Capital

$87M+ Acquisitions • Multiple Exits Exceeding Plan • Forbes Business Council

Curtis Edwards

Managing Partner, Hudson Capital

$249M+ Acquisitions • Multiple Exits Exceeding Plan • 1,553 Units Under Management

OUR TRACK RECORD

Preserving Capital. Producing Results.

35

Properties Acquired

$150M+

Raised

2,500+

Units

LP IRRs: 16%–22%

Full-Cycle Exits

Beating Plan

Vertically Integrated Operations

Regulation D 506(c) Offering — For SEC Accredited Investors Only. All investors must verify accreditation status via third party.

Disclaimers, subscription instructions, and portal access via InvestNext.

This is a Regulation D 506c offering for SEC Accredited Investors only. All investors will need to go through a third party accreditation verification process. This is not a solicitation for non-accredited investors to participate in this offering.

© 2025 | Venus Capital, LLC